Cincinnati, is Gap Insurance something you really need? I know my answer, but I thought I’d just google it and see what others thought…I found this post in the very first link I tried. It’s from a random automobile forum: “I had gap on my wife’s car that was totaled and thank God we did.

The price on her car dropped like a rock after 9-11 and about 6 months later some jerk totaled it. I have gap on 2 cars right now and it cost me $4.56 a month. Seems like a small price to pay every month but could end up providing a lot of coverage.”

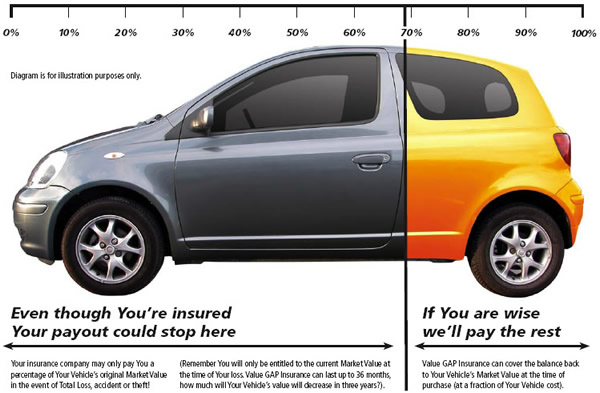

The more I looked around, the more accolades I found on the benefits of Gap Insurance and here’s why. I’ll make it simple. So, you’ve just bought a new car at $40,000. The minute you drove it off the lot it depreciated in value according to your insurance company. So, now it’s worth $30,000. You wreck that car and the insurance company gives you the $30,000 for it, but now you still owe a remaining $10,000 on a car that you aren’t even driving because it’s been totaled. Unfortunately, this happens all the time to people, but it wouldn’t happen if they had GAP insurance. See, GAP insurance will insure you for the difference between what you would owe on a vehicle and what an insurance company says it’s worth. So in other words, you would be 100% covered if you were in an accident and now you know why it’s imperative to get GAP insurance.

*The one and only reason you might not want GAP insurance on your new car is if you paid for it with cash and don’t owe anything to the bank.

When searching for GAP insurance, research all of your options because there are a few different ways to obtain it. You can get it through the dealership, your insurance company or in some cases, the bank will roll it into your loan.

Let me know if you have any experience with Gap Insurance and if YOU have any advice.